Delving Deeper: Types of Forex Market Analysis

Estimated reading time: 8 minutes

Key Takeaways

- Forex market analysis comprises technical, fundamental, and sentiment analysis.

- Each type of analysis plays a crucial role in helping traders make informed decisions.

- Proper use of analysis tools can significantly enhance trading performance.

Table of contents

- Technical Analysis: Navigating through Charts and Indicators

- Fundamental Analysis: Understanding the Underlying Currents

- Sentiment Analysis: Gauging the Market Mood

- Choosing the Best Forex Tools for Your Trading Style

- Forex Market Analysis Tools: A Newbie’s Take

- Stepping Up with Advanced Forex Tools

- Strategies for Selecting the Right Forex Tools

- Conclusion: Taking Flight with Forex Market Analysis Tools

Technical Analysis: Navigating through Charts and Indicators

Technical analysis involves the study of historical price behaviors to forecast future price movements. Traders who apply this methodology often use charts and technical indicators to study trends and patterns in the forex market.

- Price Charts: These charts present past market data in a visual format, which aids in recognizing ongoing trends, potential reversals, and varying levels of volatility.

- Technical Indicators: These are mathematical calculations based on price and volume data. They help traders identify prominent market trends, measure momentum and volatility, and establish potential entry and exit points.

Fundamental Analysis: Understanding the Underlying Currents

Fundamental analysis focuses on studying the macroeconomic factors that influence the Forex market. These factors include inflation rates, unemployment levels, gross domestic product, and political stability. A strong grasp of these elements assists traders in ascertaining the true intrinsic value of currencies and annotating potential disparities, leading to lucrative trading decisions.

- Economic Calendars: These reveal the dates and times of significant global economic events and announcements, aiding traders in understanding potential market reactions.

- News Feeds: Real-time news updates on economic and political events across the globe are equally vital for traders. These updates help track abrupt changes in the forex market and adjust their trading strategies accordingly.

Sentiment Analysis: Gauging the Market Mood

Sentiment analysis, also known as opinion mining, refers to using massive amounts of data (i.e., social media content, news articles, blogs, and forums) to ascertain the collective ‘mood’ or sentiment about a particular currency. By understanding the sentiments of other market participants, forex traders can predict potential market reversals.

- Sentiment Analysis Tools: These tools utilize algorithms and artificial intelligence to monitor and interpret the vast amount of data available online, providing insights into market sentiment.

Choosing the Best Forex Tools for Your Trading Style

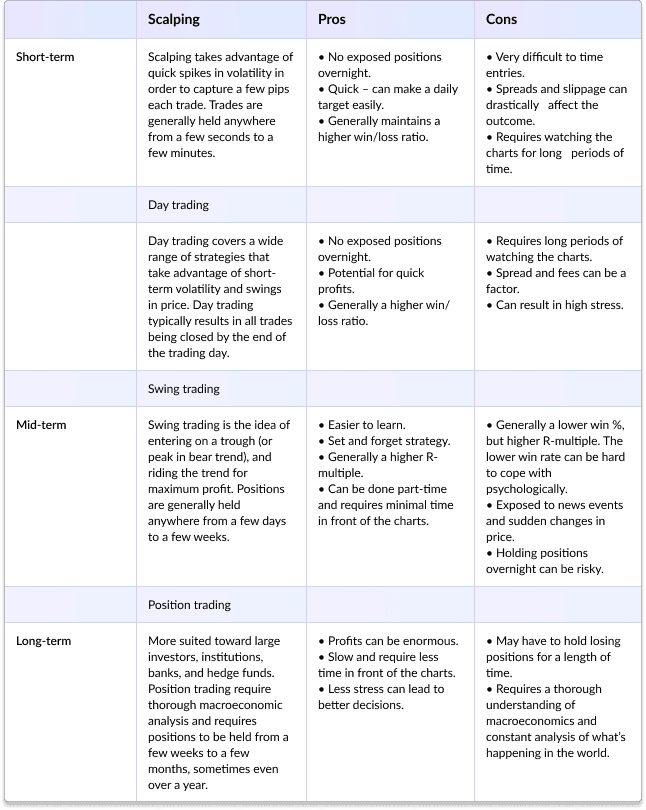

There isn’t a ‘one-size-fits-all’ tool when it comes to forex trading. Depending upon the trading method, experience level, and personal preference, different forex tools may suit different individuals. Here’s a list of some of the most beneficial tools that forex traders can use to boost their trading strategies:

- Automated Trading Tools: These allow traders to establish specific rules for both trade entries and exits that can be automatically executed by the computer.

- Forex Charts and Technical Analysis software: These offer an array of features and capabilities to further your technical analysis.

- Economic News and Data Feeds: Ensure up-to-date information with streaming news and data feeds.

- Forex Calculators: Useful in risk management, these calculators assist in evaluating potential profits and losses before placing any trades.

Forex Market Analysis Tools: A Newbie’s Take

Starting a journey in the forex market can be daunting. But with the right set of tools, beginners can successfully navigate through the thickets of this complex landscape. Here are some recommended tools for newbie traders:

- Economic Calendars: These guidelines highlight important economic events that can impact the forex market.

- Basic Charting Software: These programs offer an easy-to-understand visual representation of price trends and movements.

- Beginner-Friendly Forex Platforms: Some platforms are specially designed to be user-friendly while providing useful market analysis tools for newcomers.

Stepping Up with Advanced Forex Tools

For seasoned forex traders, advanced tools capable of offering in-depth market analysis become imperative. Depending upon the complexity of their strategies, traders can utilize a wide range of sophisticated tools:

- Advanced Charting Software: This software provides a detailed view of the market, offering a plethora of technical indicators, chart patterns, and back-testing capabilities.

- Algorithmic Trading Software: Automates trading according to predefined strategies, enabling efficient execution of complex and large volume trades.

- Microeconomic Analyzers: These tools analyze and interpret the minutiae of economic data, assisting traders in making well-informed decisions.

Strategies for Selecting the Right Forex Tools

An assortment of Forex market analysis tools can leave traders overwhelmed. To ensure you’re picking the tools that align with your trading strategy and goals, consider the following:

- Affordability: Consider your budget while selecting the tools. Free resources can be as valuable as paid ones.

- Ease of Use: Ensure that the tool is user-friendly and aligns with your level of technical proficiency.

- Reliability: Ascertain the tool’s credibility by looking for independent third-party reviews or testimonials.

- Flexibility and Compatibility: Ensure your tool of choice is cross-platform and integrates smoothly with other tools you use.

Conclusion: Taking Flight with Forex Market Analysis Tools

Currency trading in the Forex market can be an exhilarating ride. Flight in these volatile skies depends heavily on the quality of your tools and how well you use them. By selecting appropriate forex market analysis tools and combining them into a coherent trading strategy, traders can navigate the market successfully and take their trading journey to new heights.